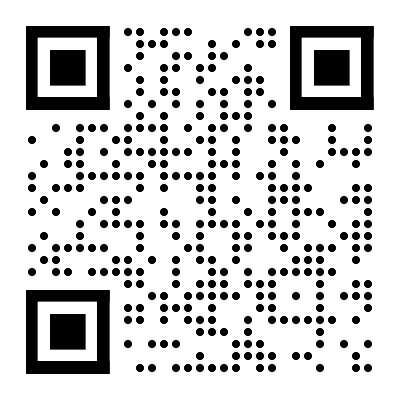

微信扫一扫联系客服

微信扫描二维码

进入报告厅H5

关注报告厅公众号

Technology is driving dramatic change in the U.S. payments system, which is a vital infrastructure that touches everyone.1 The pandemic accelerated the migration to contactless transactions and highlighted the importance of access to safe, timely, and low-cost payments for all. With technology platforms introducing digital private money into the U.S. payments system, and foreign authorities exploring the potential for central bank digital currencies (CBDCs) in cross-border payments, the Federal Reserve is stepping up its research and public engagement on CBDCs. As Chair Powell discussed last week, an important early step on public engagement is a plan to publish a discussion paper this summer to lay out the Federal Reserve Board’s current thinking on digital payments, with a particular focus on the benefits and risks associated with CBDC in the U.S. context.2 Sharpening the Focus on CBDCs Four developments—the growing role of digital private money, the migration to digital payments, plans for the use of foreign CBDCs in cross-border payments, and concerns about financial exclusion—are sharpening the focus on CBDCs.

First, some technology platforms are developing stablecoins for use in payments networks.3 A stablecoin is a type of digital asset whose value is tied in some way to traditional stores of value, such as government-issued, or fiat, currencies or gold. Stablecoins vary widely in the assets they are linked to, the ability of users to redeem the stablecoin claims for the reference assets, whether they allow unhosted wallets, and the extent to which a central issuer is liable for making good on redemption rights. Unlike central bank fiat currencies, stablecoins do not have legal tender status. Depending on underlying arrangements, some may expose consumers and businesses to risk. If widely adopted, stablecoins could serve as the basis of an alternative payments system oriented around new private forms of money. Given the network externalities associated with achieving scale in payments, there is a risk that the widespread use of private monies for consumer payments could fragment parts of the U.S. payment system in ways that impose burdens and raise costs for households and businesses. A predominance of private monies may introduce consumer protection and financial stability risks because of their potential volatility and the risk of run-like behavior. Indeed, the period in the nineteenth century when there was active competition among issuers of private paper banknotes in the United States is now notorious for inefficiency, fraud, and instability in the payments system.4 It led to the need for a uniform form of money backed by the national government.

积分充值

30积分

6.00元

90积分

18.00元

150+8积分

30.00元

340+20积分

68.00元

640+50积分

128.00元

990+70积分

198.00元

1640+140积分

328.00元

微信支付

余额支付

积分充值

应付金额:

0 元

请登录,再发表你的看法

登录/注册